Talent Finance

Talent finance is a suite of financial tools that prioritize equity in workforce development by making education and training for in-demand occupations more accessible to Coloradans who are economically disadvantaged. The information and resources below can help local stakeholders learn more and engage in talent finance efforts in Colorado.

Current Activities What is talent finance? Types of Talent Finance Resources

Past Activities

Talent Finance Primer Workshops: Exploring Resources to Address Talent Shortages

We are in a new economy that competes on talent, yet the talent financing and development systems we rely on were built for a different era and economy. This has left many Coloradans unable to access the training and education that lead to in-demand jobs, and many Colorado employers struggling to find talent.

The CWDC is offering a series of virtual workshops on Talent Finance tools—which use public-private partnerships and align incentives so that more Coloradans can access workforce training—that address inequities in Colorado’s labor market. Choose one primer below to learn about talent finance tools, solution providers, and funding mixes.

Register for Fri, Oct 25, 2024, 12 - 2 p.m.

Register for Wed, Nov 20, 2024, 12 - 2 p.m.

Register for Wed, Dec 11, 2024, 12 - 2 p.m.

- Additional Details

In our workshop, we will explore:

- Public and private innovations in talent finance.

- Shifts in employer talent strategies.

- Incentives for employers and government to work together as part of a new public-private approach to talent development that can scale promising employer, private sector, government, and service provider innovations.

- Expanding opportunity and improving diversity, equity, and inclusion in the talent marketplace.

- Who should attend?

Anyone within the Colorado Workforce Development Council Talent Found Network, Local/Regional/State Workforce Professionals/Board members, and the Sector Partnership Network. Industry collaboratives, CBOs, training providers, and educational institutions.

Colorado Innovative Finance Community of Practice // Talent Finance Design Workshop

2024 Colorado Innovative Finance Community of Practice

The CWDC invites Colorado employers, community organizations, and education and training providers to join Colorado’s Innovative Community of Practice (IFCOP) in 2024. Participants will explore outcomes-based finance tools, skilled savings accounts, and pay-it-forward funds. Participants will be introduced to talent finance service providers and potential funders.

2023 Talent Finance Design Workshop

The CWDC launched an Innovative Finance Community of Practice and partnered with Trailhead Strategies and the U.S. Chamber of Commerce Foundation to hold the state’s first Talent Finance Design Workshop. The Design Workshop, which consisted of five multi-part sessions from April - June 2023, equipped participants with the background and principles of talent finance, key frameworks, and tools to develop and implement talent finance solutions to address inequities in Colorado’s labor market.

The Design Workshop culminated in a “Pitch Day” during which 12 project teams presented their creative solutions for making training and education for high-demand jobs more accessible to Coloradans while addressing employer skills needs. Project teams were a mix of innovators from Colorado workforce centers, higher education, employers, chambers of commerce, and community-based organizations. Use the drop down menus below to learn more about each project team and the projects they developed.

For questions about the Innovative Finance Community of Practice, please email Jessica Maiorca, Innovative Financing Consultant, at jessica.maiorca@state.co.us.

- Community Outreach Service Center

Project Team: Gerald Hamel, The BASIC Project Coordinator, Community Outreach Service Center Denver, gerald@coscdenver.org

Project Description: Community Outreach Service Center COSC is focused on decreasing the laptop class divide that exists with Black and Brown students in the public school system. The Tech Intern program is a digital workforce apprenticeship program that focuses on preparing youth for a career in Information technology or college readiness. The program partners with Grow with Google for Professional IT Certificates, and paid internships with Career and College at Denver Public Schools. This small pilot scale has been extremely impactful with interns reporting that before the internship they were 80% certain they wanted to pursue a higher education degree in computer science and 100% certainty on completion after a 100 hr internship. These results indicate the need to expand the paid internships to serve more youth, and also to expand the program to include parents in the workforce program to lift them out of poverty as well.

- The Northern Colorado Hospitality Sector Partnership

Project Team:

- Adam Crowe, Economic Development Manager, Larimer County Economic and Workforce Development, acrowe@larimer.org

- Yvonne Myers, Vice President of Strategic Initiatives, Fort Collins Area Chamber of Commerce, ymyers@fcchamber.org

- Kelsey Baun, Regional Talent, Larimer County Economic and Workforce Development, baunkc@co.larimer.co.us

Project Description: The Northern Colorado Hospitality Sector Partnership has identified significant employee retention challenges throughout their industry. Additionally, members of the partnership have reported increasing difficulties finding individuals to fill key leadership positions. Knowing that incumbent worker apprenticeship models have helped overcome similar challenges in other industries, our group is proposing the creation of an apprenticeship pilot that will create a pathway into hotel management positions.

Learn more about Northern Colorado Hospitality Sector Partnership presentation.

- Behavioral/Mental Health Practitioner

Project Team:

- Todd Nielsen, Director, Colorado Urban Workforce Alliance, todd.nielsen@denvergov.org

- Michelle Foley, Associate Director, Jefferson County Workforce and Business Center, mfoley@co.jefferson.co.us

- Lindsay Bullock, Workforce Center Director, Mesa County, lindsay.bullock@mesacounty.us

- Erin Jones, Executive Director, Boulder County Workforce, epjones@bouldercounty.org

- Janel Highfill, Associate Vice President, Workforce Development, Front Range Community College, Janel.Highfill@frontrange.edu

- Chris Dewhurst, Deputy Director of Human Services, City and County of Broomfield, cdewhurst@broomfield.org

Project Description: Have you or a loved one experienced a need for a behavioral/mental health practitioner and experienced significant waits for the first encounter? This innovative project is designed to expand access to careers in behavioral health for under-represented populations including those who have experienced substance abuse or other behavioral health challenges; indigenous, Latino and other minority populations; LGBTQ+ and others. By identifying in-demand career pathways and creating opportunities for stackable credentials with advancement opportunities at different education and credential thresholds, this project aims to fill the workforce pipeline, while also easing access for credential seekers. In order to complete this, alternative finance options are needed for the entry-level portions of the pathway where traditional financial aid and other educational funding are insufficient.

Learn more about Behavioral/Mental Health Practitioner presentation.

- Western Colorado University’s Online Paraprofessional-To-Teacher Pipeline

Project Team:

- Dr. Terry Schliesman, Director, Adult Degree Completion, Western Colorado University, tschliesman@western.edu

- Sherri Anderson, Director of Educator Preparation, Western Colorado University, sanderson@western.edu

Project Description: K-12 teachers are in demand across Colorado and interest among traditionally-aged college students, to become teachers, has waned. This pitch focuses on Western Colorado University’s online paraprofessional-to-teacher pipeline, focusing on the need for third-party funding to help ensure an affordable pathway for invested paras to upskill into qualified teachers for the benefit of children and communities across Colorado.

What is talent finance?

Talent finance is a suite of financial tools that prioritize equity in workforce development by making education and training for in-demand occupations more accessible to Coloradans who are economically disadvantaged. The CWDC’s work in this area is aligned to the work of the U.S. Chamber of Commerce Foundation and is designed to support the adoption of new models into the state of Colorado.

Learn more about the various types of talent finance and access resources.

For employers, talent finance...

- Provides access to a larger and more diverse talent pool, since talent finance reduces barriers for learners to access training.

- Allows shared risk with others, including the public sector.

- Gives more control over training content. With talent finance, compensation to a training provider or a learner’s repayment of a loan is triggered by a learner not only graduating training but gaining employment. Therefore, it’s in the training provider’s interest to ensure the learner is trained in skills that an employer needs. This dynamic enables employers to be specific about the skills for which they need training.

For learners, talent finance...

- Aligns incentives among stakeholders. What this means is that a learner’s success is also success for the training provider, funder, and buyer. With traditional student loans, a learner repays their loan regardless of whether the learner graduates or gains employment (i.e. outcomes). With a talent finance tool such as an outcomes-based loan, a learner repays their loan only after certain outcomes are met: the learner graduates and gains employment, for example.

- Lessens the risks to learners by addressing their constraints, which can be financial as well as day-to-day resources (e.g. childcare, access to internet, transportation, etc.).

For training providers, talent finance...

- Expands reach to more diverse communities.

- Provides an opportunity to operationalize flexibility by modifying training in response to frequent changes in employer skills’ demands.

- Requires the collection of outcomes data on participants, which provides a feedback loop for training providers that they can use to improve programs.

- Encourages competition and transparency, allowing learners to identify the most effective training programs.

For funders, talent finance...

- Can scale training programs for high-demand occupations with labor shortages.

- Systematically reduces barriers to entry to training so that low-income learners can gain employment in high-growth sectors and create a more inclusive economy and tax base.

- Creates transparency by requiring outcomes to be defined and measured.

Outcomes-based Finance

Outcomes-based finance is a group of financial arrangements in which money is provided based on outcomes. For outcomes-based contracts, a payee receives payment when certain outcomes are reached. For income share agreements, a borrower repays a loan when certain outcomes are reached, with repayment based on the borrower’s income. For outcome-based loans, a borrower repays a loan when certain outcomes are reached, with terms different from an ISA.

Outcomes-based Contracts

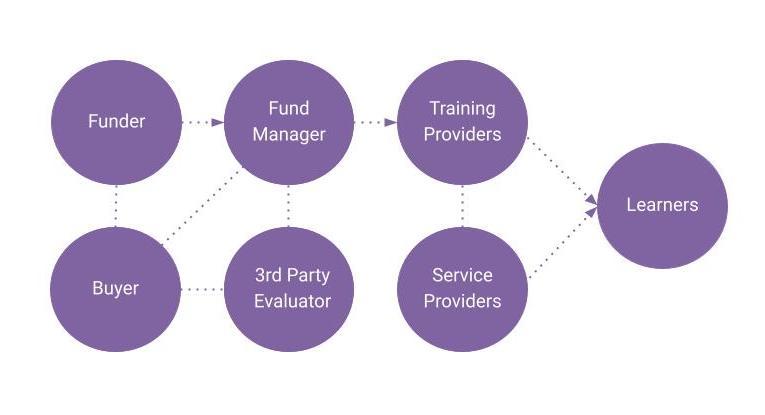

An outcomes-based contract is a financial agreement in which a funder contracts a training provider and/or service providers for certain training and education outcomes for learners. Once a 3rd party evaluator verifies those outcomes, the fund manager releases funds to the training providers.

- Diagram Explanation

-

- The Funder provides funds for the operation. A Funder can be a private entity (e.g. industry coalition, single employer, financial institution, philanthropy) or public entity (e.g. government). There is often more than one Funder in an outcomes-based contract program.

- The Buyer is the organization needing learners to be trained. A Buyer can be an industry coalition, single employer, or government entity. There can be more than one Buyer in an outcomes-based contract. Sometimes a Buyer is also a Funder.

- The Fund Manager releases funds to the Training Provider based upon a 3rd Party Evaluator’s determination that the Training Provider met their agreed-upon outcomes.

- The 3rd Party Evaluator determines whether the Training providers and/or Service providers achieved their agreed-upon outcomes for training and support. Some outcomes-based contracts do not have a 3rd Party Evaluator.

- Training providers provide training based upon the needs of the Buyer and in coordination with the Funder. The parties determine outcomes, how they will be measured, and how training providers will be compensated for said outcomes.

- Service providers provide wraparound services (or the financial equivalent of) based upon the needs of the learner. Wraparound services include food, childcare, internet access, cell phones, laptops, books, training equipment, transportation, stipends, etc.

- The Funder provides funds for the operation. A Funder can be a private entity (e.g. industry coalition, single employer, financial institution, philanthropy) or public entity (e.g. government). There is often more than one Funder in an outcomes-based contract program.

- Examples

-

What this could look like: Several Colorado behavioral health centers band together as the Buyer. These behavioral health centers are facing a massive shortage of case managers, and lack the capacity and funding to recruit and train the number of case managers they need. So they approach the State of Colorado and a philanthropic foundation - collectively referred to as the Funder - for funding. The Funder gives their money to a Fund Manager [press], who will be in charge of managing and releasing funds later in the process. Together, the Buyer and Funder identify a few Training Providers who can train learners to be case managers. The parties agree that the Funder will compensate $1k to each Training Provider for each Learner who completes a Training Provider training. The Funder will compensate $2k to each Training Provider for each Coloradan who completes training and gains employment at one of the local behavioral health centers. Prior to training the first group of Learners to become case managers, the Training Providers note that many of the Learners need childcare while they are in training. The Training Providers therefore bring in a Service Provider to provide childcare stipends to Learners who need it. After training is completed, a 3rd Party Evaluator confirms the Training Providers’ outcomes (i.e. the number of Coloradans who completed case management training as well as the number of Coloradans who were then employed as case managers). Once those outcomes are confirmed, the Fund Manager releases the appropriate amount of funds to the Training Providers.

Examples:

- New York Increasing Employment and Improving Public Safety

- Massachusetts Juvenile Justice PFS

- Massachusetts Pathways to Economic Advancement

- Pay for Success and Workforce Development in Delaware

- Philadelphia Workforce Development

- Retention-based Contracts with Seedco and Employer Partners

- Texas Workforce Commission

- Utah Employability to Careers

- Veterans CARE

Outcomes-based Loans

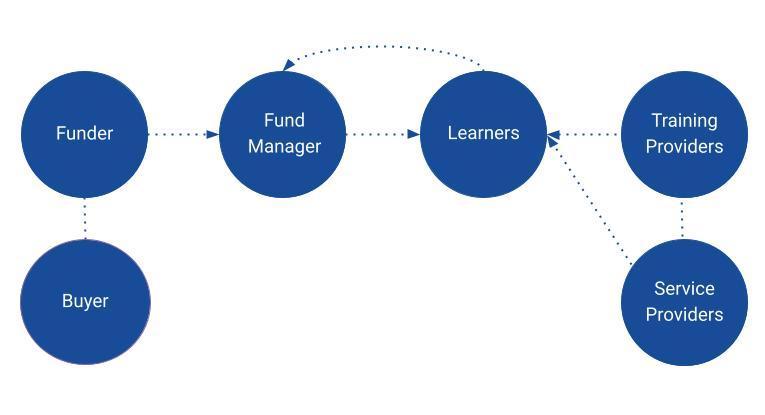

An outcomes-based loan is a loan agreement in which a Funder loans money through a Fund Manager to a Learner to cover the costs of training or education. The Learner repays the money only when certain outcomes are met, which may include the Learner graduating training, gaining employment in an occupation related to the training, and earning a salary that meets or exceeds a minimum salary threshold. If the Learner’s salary is lower than the minimum salary threshold, the Learner does not repay the loan. The repayment amount is a percentage of the Learner’s income. Other loan terms may include caps on the loan’s total duration and total number of payments.

- Diagram Explanation

-

- The Funder provides funds for the operation. A Funder can be a private entity (e.g. industry coalition, single employer, financial institution, philanthropy) or public entity (e.g. government). There is often more than one Funder in an outcomes-based loan program.

- The Buyer is the organization needing learners to be trained. A Buyer can be an industry coalition, single employer, or government entity. There can be more than one Buyer in an outcomes-based loan. Sometimes a Buyer is also a Funder.

- The Fund Manager releases funds to Learners and later accepts their loan repayments.

- A Learner takes a loan from the Fund Manager. The Learner signs a loan agreement that generally includes the following terms: The Learner will repay the loan once the Learner graduates the training program, gains employment in an occupation related to the training, and makes at least the minimum salary threshold.

- The terms may also include a cap on the number of loan payments the Learner will pay, along with a cap on the duration of the loan (regardless of whether the loan has been fully repaid).

- The Training Provider provides training to the Learner. The Learner may access Service providers for wraparound services (or the financial equivalent of) based upon the learner’s needs. Wraparound services include food, childcare, internet access, cell phones, laptops, books, training equipment, transportation, stipends, etc.

- The Funder provides funds for the operation. A Funder can be a private entity (e.g. industry coalition, single employer, financial institution, philanthropy) or public entity (e.g. government). There is often more than one Funder in an outcomes-based loan program.

- Examples

-

What this could look like: A tech company and a philanthropic foundation are collectively the Funder. They combine their funds to create a small fund that will provide loans to learners who want to attend coding bootcamps. The tech company is also the Buyer because it wants to employ those learners who graduate the bootcamps with coding certificates. A Learner borrows $10k from the fund to attend a coding bootcamp. The loan comes with the following terms: The Learner must begin repaying the 0% interest loan once they graduate the coding bootcamp, are employed in a coding job, and are making a minimum salary threshold of $40k. The Learner graduates the bootcamp, gets a coding job making $40k, and so begins repaying the loan to the Fund Manager. However, a few months later, due to the COVID-19 pandemic, the Learner is laid off. Since the Learner’s income has now dipped below $40k, the Learner is allowed to stop repaying the loan. A few months later, the Learner gets another coding job making $45k. At that point, the Learner will resume loan repayment.

Examples:

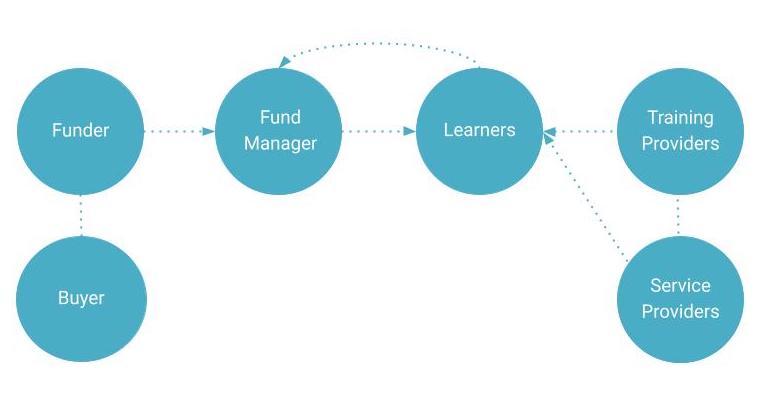

Income Share Agreements

An Income Share Agreement (ISA) is a loan agreement in which a Funder loans money through a Fund Manager to a Learner to cover the costs of training or education. The Learner repays the money only when certain outcomes are met, which includes the Learner graduating training, gaining employment in an occupation related to the training, and earning a salary that meets or exceeds a minimum salary threshold. If the Learner’s salary is lower than the minimum salary threshold, the Learner does not repay the loan. The repayment amount is a percentage of the Learner’s income. Other loan terms include caps on the loan’s total duration and total number of payments.

- Diagram Explanation

- The Funder provides funds for the income share agreements (ISAs). A Funder can be a private entity (e.g. industry coalition, single employer, financial institution, philanthropy) or public entity (e.g. government). There is often more than one Funder in an ISA program.

- The Fund Manager releases funds to Learners and accepts loan repayments from Learners.

- A Learner takes a loan from the Fund Manager. The Learner signs a loan agreement that includes the following terms: The Learner will repay the loan once the Learner graduates the training program, gains employment in an occupation related to the training, and makes at least the minimum salary threshold. The terms also include a cap on the number of loan payments the Learner will pay, along with a cap on the duration of the loan (regardless of whether the loan has been fully repaid).

- The Training Provider provides training to the Learner. The Learner may access Service providers for wraparound services (or the financial equivalent of) based upon the learner’s needs. Wraparound services include food, childcare, internet access, cell phones, laptops, books, training equipment, transportation, stipends, etc.

- The Funder provides funds for the income share agreements (ISAs). A Funder can be a private entity (e.g. industry coalition, single employer, financial institution, philanthropy) or public entity (e.g. government). There is often more than one Funder in an ISA program.

- Examples

What this could look like: A tech company and a philanthropic foundation are collectively the Funder. They combine their funds to create a small fund that will provide ISA loans to learners who want to attend coding bootcamps. The tech company is also the Buyer because it wants to employ those learners who graduate the bootcamps with coding certificates. A Learner borrows $10k from the fund to attend a coding bootcamp. The loan comes with the following terms: The Learner must begin repaying the 2% interest loan once they graduate the coding bootcamp, are employed in a coding job, and are making a minimum salary threshold of $40k. Also, the number of loan payments is capped at 60 and the loan's total duration is capped at 60 months. The Learner graduates the bootcamp, gets a coding job making $40k, and so begins repaying the loan to the Fund Manager. However, a few months later, due to the COVID-19 pandemic, the Learner is laid off for one year. Since the Learner’s income has now dipped below $40k, the Learner is allowed to stop repaying the loan. Note: The 12 months of being laid off counts towards the loan's total duration of 60 months. Now let’s pretend that after one year, the Learner gets another coding job making $45k. At that point, the Learner will resume repayment of the loan.

Examples:

Lifelong Learning Accounts

A Lifelong Learning Accounts (LiLA) is a worker-owned, mobile (i.e. portable from job to job) account that bears interest that a worker uses to pay for training and education throughout the course of their professional life. An employer may contribute to an employee's LiLA. The training or education does not need to be relevant to the employee's current job.

What this looks like: Employees at Company X can contribute up to $1k/yr into a portable, interest-bearing account and Company X will match half of the employee’s contribution. Accounts are available to employees who have worked at Company X for at least 3 years. Employees may use the money to develop skills not related to their current jobs.

- Examples

-

- Maine, 2005. Working with CAEL, Maine established the LiLA program, pulling together the state’s Department of Labor; Maine Career Centers, providing enrollment assistance for employers and employees; Maine Centers for Women, Work and Community, providing career and education advisory services; and the Finance Authority of Maine (FAME), providing the funding vehicle for LiLAs in the form of a 529 account—a tax-advantaged savings plan for college costs. Employers provide a match of at least $300. For families with annual incomes of less than $75,000, FAME contributes $200 to each LiLA account.

- The Council for Adult and Experiential Learning (CAEL) has developed and championed Lifelong Learning Account demonstration programs in a handful of states and cities, including Maine, Washington, Chicago, and New York City.

- The University of California San Francisco Medical Center set up a LiLA program, which was available to medical and other campus employees, and was so pleased with it that it implemented a second LiLA pilot program targeting employees at the medical center ages 55 and older who earn less than $60,000 a year.

- IBM: $60m Global Citizen’s Portfolio, which includes the Matching Accounts for Learning initiative. Under the program, employees can contribute up to $1k/yr into a portable, interest-bearing account, and the corporation will match half that. The money is designed to be used for employees to enhance skills not directly related to their current jobs, such as taking Mandarin or learning to operate a small business. The accounts were available initially to any US employee who worked at IBM for at least five years.

- Maine, 2005. Working with CAEL, Maine established the LiLA program, pulling together the state’s Department of Labor; Maine Career Centers, providing enrollment assistance for employers and employees; Maine Centers for Women, Work and Community, providing career and education advisory services; and the Finance Authority of Maine (FAME), providing the funding vehicle for LiLAs in the form of a 529 account—a tax-advantaged savings plan for college costs. Employers provide a match of at least $300. For families with annual incomes of less than $75,000, FAME contributes $200 to each LiLA account.

Learn More

Resources

Use the drop down menus below to explore reports and legislation related to talent finance in Colorado and across the country.

- Reports

Roadmap and Action Plan: Innovative Financing As a Tool For Accomplishing Colorado’s Talent Equity Agenda. The Colorado Workforce Development Council, October 2021 (Updated June 2022).

Exploring Racial and Gender Differences in ISA Contract Terms and Repayment Patterns. Jobs for the Future, April 2022 (Pollack, Ethan, and Felicia M. Sullivan).

Issue Brief: Can Student-Centered Income Share Agreements Improve Economic Opportunity and Equity? The Aspen Institute Future of Work Initiative, November 2020 (Pollack, Ethan).

An Economic Perspective of Income Share Agreements. Congressional Research Service, July 15, 2019 (Keightley, Mark P).

- Legislation Related to Talent Finance

Federal, 2022. ISA Student Protection Act of 2022 (SB 4551), introduced in the Senate

Federal, 2021. Skills Investment Act (HR 1242), not passed

Illinois, 2021. Know Before You Owe Private Education Loan Act (110 ILCS 983), passed

Illinois, 2021. Predatory Loan Prevention Act (815 ILCS 123), passed

California, 2020. Student Loan Servicing (AB-376), passed

Federal, 2019. ISA Student Protection Act of 2019 (SB 2114), introduced in the Senate

Federal, 2019. Lifelong Learning and Training Account Act (HR 4017), not passed

Federal, 2019. To amend the Internal Revenue Code of 1986 to provide for lifelong learning accounts, and for other purposes (HR 898), not passed

Federal, 2018. Lifelong Learning and Training Account Act (HR 7235), not passed

Federal, 2013. Skills Investment Act (HR 1939), not passed

Washington, 2012. Lifelong Learning Program (SB 6141), pilot in 2009

Federal, 2011. Lifelong Learning Accounts Act (HR 1869), not passed

Federal, 2010. Lifelong Learning Accounts Act (HR 5715), not passed

Federal, 2008. Lifelong Learning Accounts Act (HR 6036), not passed

Hawaii, 2007. “Tax credits” mentioned in the HD1 version are deleted in the HD2 version. However, the bill also creates a rapid response revolving fund.

Illinois, 2006. SB2931 provides matching funds for LiLAs. This bill provided $400k in state matching funds to administer a statewide LiLA program in the healthcare sector. It also provided funding for support services, such as education and career advising. Contributions by individuals and their employers are matched at a rate of 2:1 up to $500.

Iowa, 2007. HSB754 says, “An employer shall be entitled to a lifelong learning account tax credit equal to fifty percent of the employer's annual aggregate lifelong learning account contributions made in the employer's tax year to the lifelong learning accounts established on behalf of the employer's employees. The maximum annual contribution which qualifies for the credit is five hundred dollars per employee.” (Not sure if passed.)

Minnesota, 2007. HF2779 sought to provide employers with a non-refundable tax credit of up to $500, which was equal to the amount contributed on behalf of their employees. It also proposed that workers receive a refundable tax credit of up to $500 per year, which would be equal to 50 percent of their annual contribution. The bill sought to levy a tax of up to 25 percent on any nonqualified withdrawals that were made by employees. (Looks to have passed.)

Indiana, 2006. HB1173 sought $300k in state funds to administer a LiLA Grant Program. This program proposed that individual workers receive $500 per year in matching funds if they paid any part of their own educational expenses.

Oklahoma, 2005. SB927 sought to provide a corporate income tax credit for LiLA contributions made by employers. The yearly employer tax credit would be capped at $500 per employee and could not exceed $50,000 over the life of the program. Employees were allowed to treat LiLA contributions as non-taxable income.

Connect With Us

Jessica Maiorca

Sr Consultant, WIOA and Policy Innovation

Colorado Workforce Development Council

jessica.maiorca@state.co.us

(720) 232-1422

Join the conversation on social media: #TalentFinanceCO and #TalentFinance